foreign gift tax india

Tax on gifts in India falls under the purview of the Income Tax Act as there is no specific gift tax after the Gift Tax Act 1958. Foreign Gift Tax India.

How Are Gifts Taxed In India Gift Taxation Exemption

Part then gifts whether received from india or abroad will be charged to tax.

. Gifts from relatives who are covered in the definition above may not be taxable in India. In the current case the Indian parents are not US persons and are not. Any gift received for more than Rs50000 is taxed.

Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax. This reporting rule is the purpose of Form 3520 which is the form you must file with the Internal Revenue Service IRS when you a US. Foreign Gift Tax India.

Person who received foreign gifts of money or other property you may need to report these gifts on form 3520. However gifts from friends or non relatives may be taxable if the aggregate value. In addition gifts from specific relatives like parents spouse and siblings are also exempt from tax.

Citizen receive gifts or bequests from. Or Received more than 16111 for 2018 adjusted annually. This includes foreign persons related to that nonresident alien individual or foreign estate that you treated as gifts or bequests.

Is Gift tax still in India. Gifts of movable properties outside India unless the donor-. For purported gifts from foreign corporations or foreign partnerships you are required to report the receipt of such purported gifts only if the aggregate amount received from all entities.

Residents to a non-resident person are subjected to tax in India the Finance No. Note that in india tax year is referred to as financial year and. 16 rows Estate Gift Tax Treaties International US.

A gift of any form of cash cheque land building or property is taxable if it exceeds Rs. Foreign gift tax india Sunday April 24 2022 Edit. Gifts up to Rs 50000 per annum are exempt from tax in India.

Person who received foreign gifts of money or other property you may need to report these gifts on form 3520. Approximately 135 percent of the current US. Accordingly finance act 2019 no.

Foreign gift tax india. Accordingly finance act 2019 no. 2 Act 2019 has inserted a new clause viii under Section 9 of the Income-tax Act to provide.

Gift From Usa To India Taxation And Exemptions Sbnri

Cleartax S Infographic Of What Incomes And Losses The Different Itr Forms Include And Exclude Residual Income Business Income Tax Return Website Income

Did You Receive Gift Tax Implications On Gifts Examples Limits Rules

File Manager In Eztax In App Filing Taxes Income Tax Self

All About Msme Loans Under 59 Minutes In India Eztax In Tax Software Accounting Accounting Software

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Tax On Gifts In India Fy 2019 20 Limits Exemptions And Rules

Importance Of Pan Number Savings Bank Income Tax Income

Income Tax Slab Rates In India For F Y 2018 19 For Super Senior Citizen Income Tax Income Tax

Tax Implications On Money Transferred From Abroad To India Extravelmoney

Yes Reserve Bank Has Granted General Permission To Foreign Citizens Of Indian Origin To Acquire Or Dispose Of Properties Up To The Originals Citizen Ahmedabad

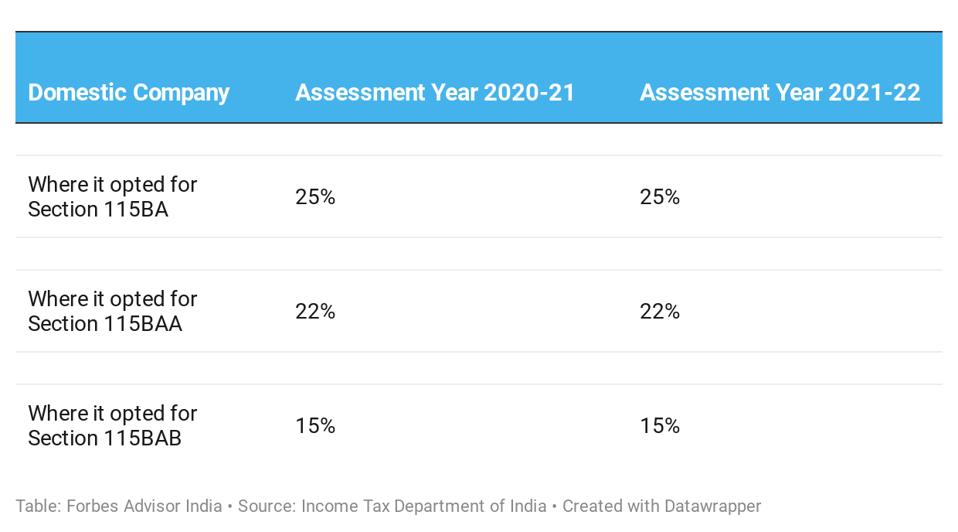

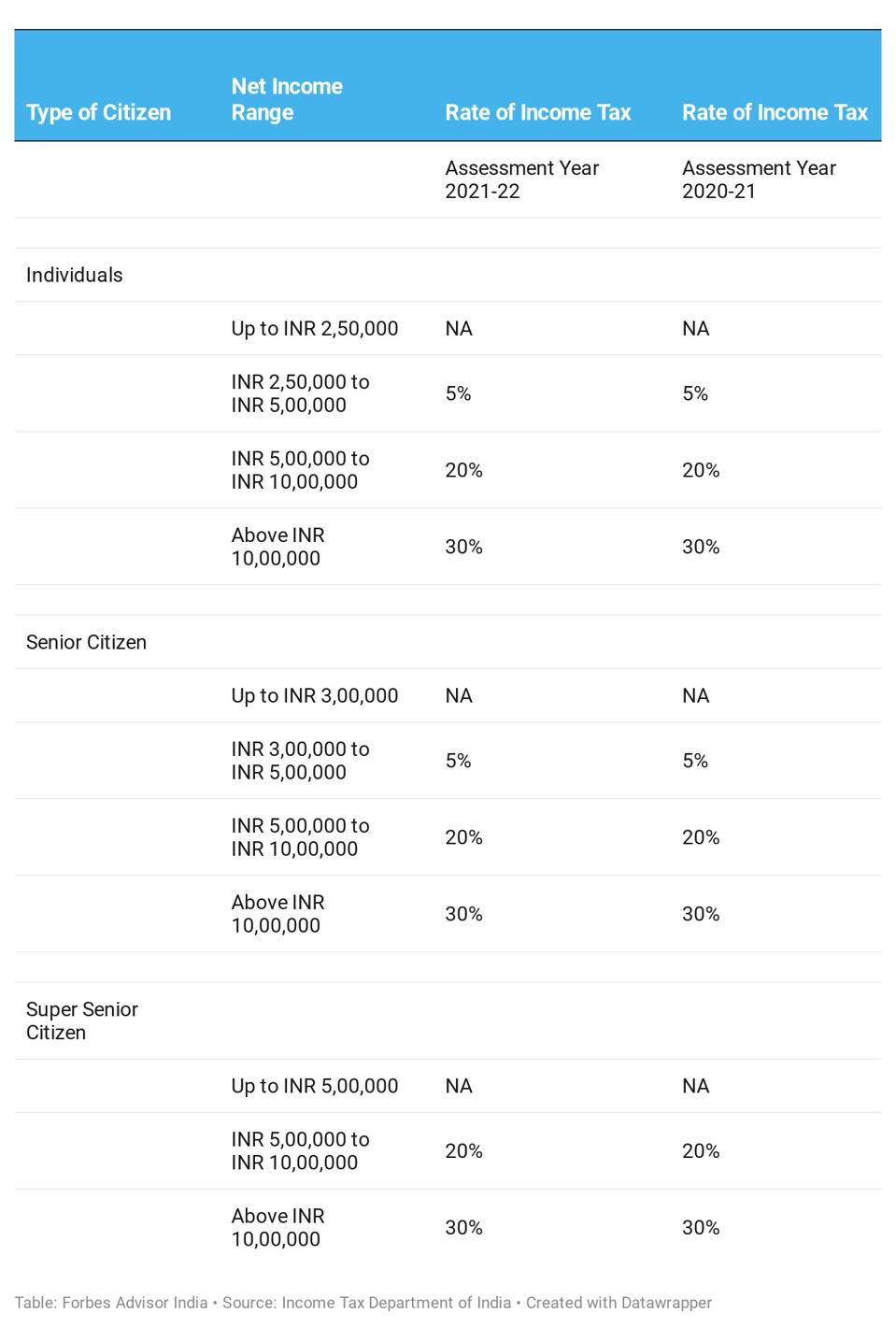

Know Types Of Direct Tax And Charges Forbes Advisor India

Best Time To Send Money To India From Usa Send Money Money Forex

Gift From Usa To India Taxation And Exemptions Sbnri

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable